The Registered Retirement Savings Plan (RRSP) has been around for 60 years to help Canadians save for retirement.

RRSPs are popular because you receive an immediate tax deduction when you contribute to your RRSP, plus any investment growth is tax-deferred until you begin withdrawing funds. If your employer matches contributions, you should definitely consider it; we can set this up for businesses too.

Meanwhile, you should also be considering Tax-Free Savings Accounts (TFSAs), which can be used to save for retirement but also short-term financial goals like a home or vehicle. TFSA contributions are made with after-tax dollars, so although you won’t receive a tax deduction like with RRSPs, all investment growth within the account and any TFSA withdrawals are tax-free.

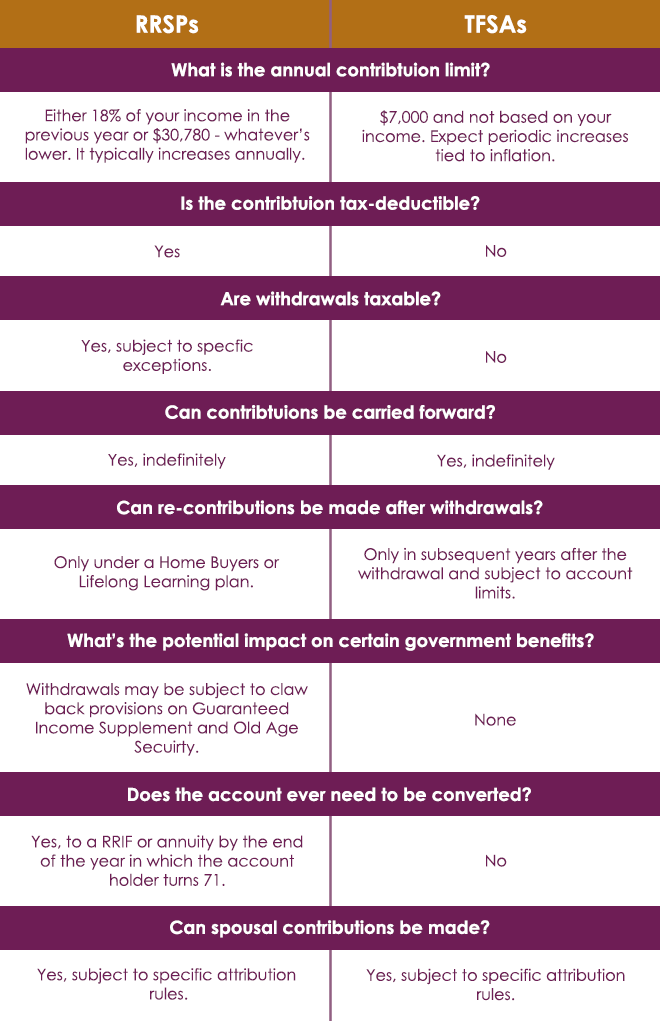

Both RRSPs and TFSAs can help you be prepared for retirement, knowing the differences between the two is an important part of your planning.