Reaching your goal of buying your first home is now a little easier with the new First Home Savings Account (FHSA).

The account is designed to help first-time homebuyers by offering combined benefits from a Registered Retirement Savings Plan (RRSP) and a Tax-Free Savings Account (TFSA). Like an RRSP, contributions you make to a FHSA are tax-deductible; like a TFSA, withdrawals you make to purchase a first home will not be taxable.FHSA is available for Canadians, who are 18 years old or older. A first-time homebuyer (meaning, you and/or your spouse or common-law partner) have not owned a home in the year the account is opened or the preceding four calendar years.

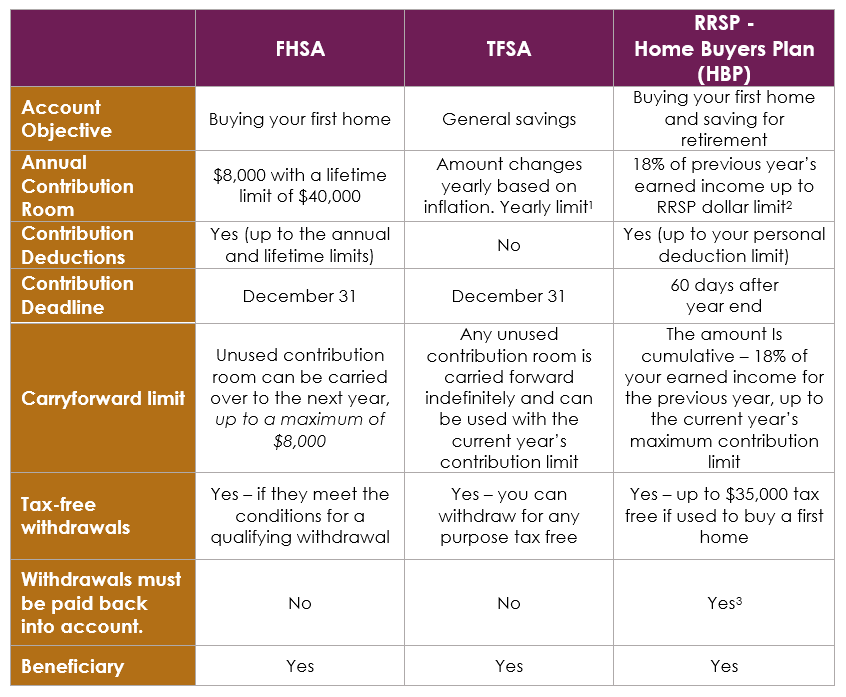

1 Yearly limit 2 RRSP dollar limit 3 HBP withdrawals must be repaid to an RRSP over a maximum of 15 years starting the second year following the withdrawal to remain tax free.

Reasons to open a FHSA

Pay Less Taxes

Contributions into your FHSA are tax-deductible, which reduces your taxable income for the current year – which means a nice discount at tax time.

Grow Savings Faster

FHSA offers daily interest on your contributions, meaning as soon as you put money into the account you will gain compounding interest. Your money will grow quicker resulting in a considerable foundation for your down payment.

Flexible Investments

Your FHSA can be held in a variety of investments including mutual funds, exchange-traded funds (ETFs), publicly traded securities, government and corporate bonds, and guaranteed investment certificates (GICs).

If you decide to use the funds for something other than a home, you can transfer the money into an RRSP or Register Retirement Income Fund (RRIF) without affecting your contribution room.

We’re here to help you get one step closer to accomplishing one of the biggest financial milestones. Book an appointment today to open your First Home Savings Account to start accelerating your savings toward buying your first home.